The Partnership Success/Failure Formula

As 2024 comes to a close, I’ve been reflecting on my entrepreneurial journey and all the partnerships I’ve been through.

In summary:

- Seven businesses,

- Two decades of experience and,

- Only two of those partnerships really worked out.

Facing Reality

65% of startups fail because of partnership issues. I’m not just quoting statistics here - I’ve lived this reality, and I’ve watched many of my founder friends go through the same struggles. After a lot of self reflection and reading, I’ve arrived at a formula that can explain partnership success or failure.

The Partnership Formula

Partnerships are really simple at their core. They succeed when everyone gets more out of it than what they put in.

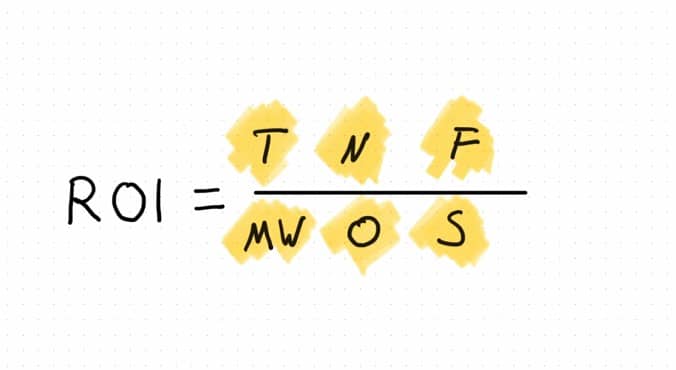

It’s all about ROI – Return on Investment.

But this isn’t your typical ROI calculation where you can punch numbers into a spreadsheet and get a clear answer.

Every partner has their own way of valuing what they get and what they give. It’s like we’re all using different currencies, trying to figure out if we’re getting a good deal.

And then there’s the future factor – that uncertain promise of what’s to come. One partner might see a goldmine ahead, while another sees a dead end. I’ve watched solid partnerships crumble simply because one person lost faith in the startup’s future while the other was still all in.

Despite all these complications, I believe this formula can help explain why partnerships succeed or fail, even if we can’t calculate it precisely.

Partnership ROI = (Tangible Value + Now + Future) / (Money/Work + Opportunity Cost + Soft Factors)

Above the line, we’ve got what you get:

- Tangible stuff (think salary, equity, real money in your pocket)

- The “now” experience (your daily satisfaction and growth)

- Future potential (the big payoff you’re working toward)

Below the line, there’s what you give:

- Money or work (your actual sweat and cash investment)

- Opportunity costs (what you’re giving up to be here)

- Soft factors (relationships, location flexibility, your peace of mind)

Let’s break each part down with examples

Tangible Value (T)

Every partner needs to get some tangible value from their partnership. This can come as a salary, dividends or equity - but some real money that goes to your pocket.

Back in 2013, I partnered up to launch a SaaS company focused on the relocation industry. Within a year, I made the tough decision to step away.

Why? It simply wasn’t making enough money. We couldn’t get past product-market fit, which meant too few customers and no revenue for founder salaries. I ran out of money and could not work for free any more. That’s when I knew it was time to call it quits.

The Now Factor (N)

This is about when the daily work just isn’t good enough. When whatever sacrifice you’re making today feels too hard and not worthwhile. I’ve seen this a lot, especially between technical and non-technical founders.

Perfect example: my friend who left a profitable company because his work wasn’t appreciated. This happens all the time with developers and non-technical co-founders. The developer puts in tons of work that never “reaches the light” – the sales side just doesn’t see or appreciate it. That’s when resentment builds and partnerships break.

The Future Factor (F)

Sometimes the value isn’t immediate – it’s about future potential. Think internships: low pay now, but high future value through learning.

But here’s the catch: if that learning stops, if someone isn’t growing anymore, the partnership value tanks quickly.

Money/Work

Let me share another story that taught me about investment balance. I started an e-learning SaaS with a marketing co-founder - me handling tech, them handling sales. We each agreed to put in $3,000.

Fast forward a couple of months. The software development turned out to be more complex (and expensive) than I initially estimated. I kept footing bigger and bigger bills. When I asked my co-founder to match the investment to keep things equal… they said no.

I couldn’t even blame them - it was my technical decisions that made things more complicated. But once the investment balance tipped, the partnership couldn’t survive. We had to fold because neither of us could justify putting in more.

The Hidden Cost of Opportunities (O)

Here’s something people often overlook - opportunity cost. Every hour you spend on a partnership is an hour you can’t spend elsewhere. And sometimes, life throws you curveballs that change everything.

A good example is a partnership where one founder had a family business on the side. Everything was going fine until that family business started booming - they were expanding into real estate and needed all hands on deck.

Suddenly, staying with the partnership meant giving up a golden opportunity with the family business. The opportunity cost became so high it dragged down the whole partnership formula.

The Soft Factors That Make or Break (S)

Finally, there’s what I call the “soft things” - they’re hard to measure but do they matter. Think about someone bringing their entire professional network to the table. That can be a huge value-add, but try putting a price tag on it.

Or consider having to relocate to a new city for the partnership. Giving up your location freedom, maybe moving away from family - these things don’t show up on a balance sheet, but they’re real costs every partner has to consider.

Where I Am Today

Right now, I’m running two partnerships that perfectly demonstrate this formula:

- A cash cow business: High value up top, low demands below the line - it just works.

- A high-stakes startup: Big investment required, but the potential returns match it.

Both work because everyone’s equation balances out - we all see the value matching our investment.

Does this match your reality?

I’ve shared my formula and my stories. Now I’d love to hear yours. How have your partnerships played out? What made them succeed or fail? Drop a comment below or shoot me an email.